ev tax credit 2022 cap

Up to 600 for the purchase of a home charging station. Increasing the base credit amount to 4000 from 2500 is.

.jpg)

Latest On Tesla Ev Tax Credit March 2022

If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000.

. Toyota is about to launch the all-electric bZ4X electric SUV in the middle of 2022 but its going to be in a tricky situation. The last thing pending is the EV tax credit provisions in the Build Back Better Act so hopefully this will also pass in 2022. The IRS will not go over and above this total tax liability figure and in this example the remaining 4500 of the EVs total tax credit will not be useable.

The 7500 EV tax credit called 30D by the IRS is currently the biggest consumer incentive put forward by the federal government to foster. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. But the Kia Niro EV is eligible for the full 7500 tax credit because of its larger battery size.

As part of a separate bill legislators are considering a 2500 federal tax credit for used EVs as well. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Resident populations of the 50 states the District of Columbia Puerto Rico and the insular areas for purposes of determining the 2022 calendar year 1 state housing credit ceiling under section 42 h of the Code 2 private activity bond volume cap under section 146 and 3 private activity bond volume limit.

From 2020 you wont be able to claim tax credits on a Tesla. Up to 4000 for the purchase of a used all-electric vehicle. 2022 Chevrolet Bolt EV.

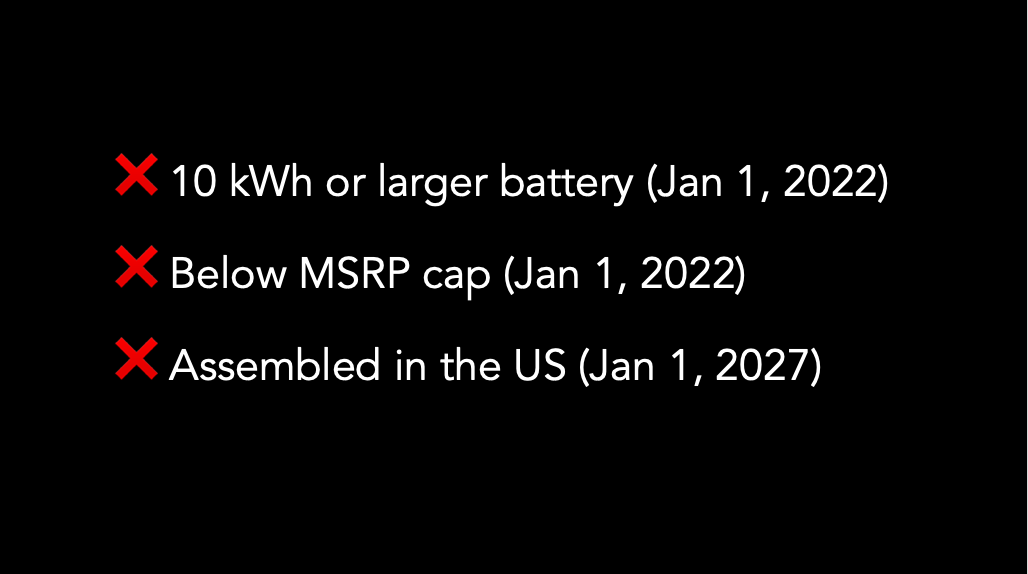

Worried that if variables like the battery size income cap msrp cap change I could be out of all the 7500. What changes on Jan 1 2022 is the increase to 10000 for American made 12500 for union American made vehicles and it will be a refundable tax credit. From April 2019 qualifying vehicles are only worth 3750 in tax credits.

What Is the New Federal EV Tax Credit for 2022. The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. As mentioned below however the 10 kWh.

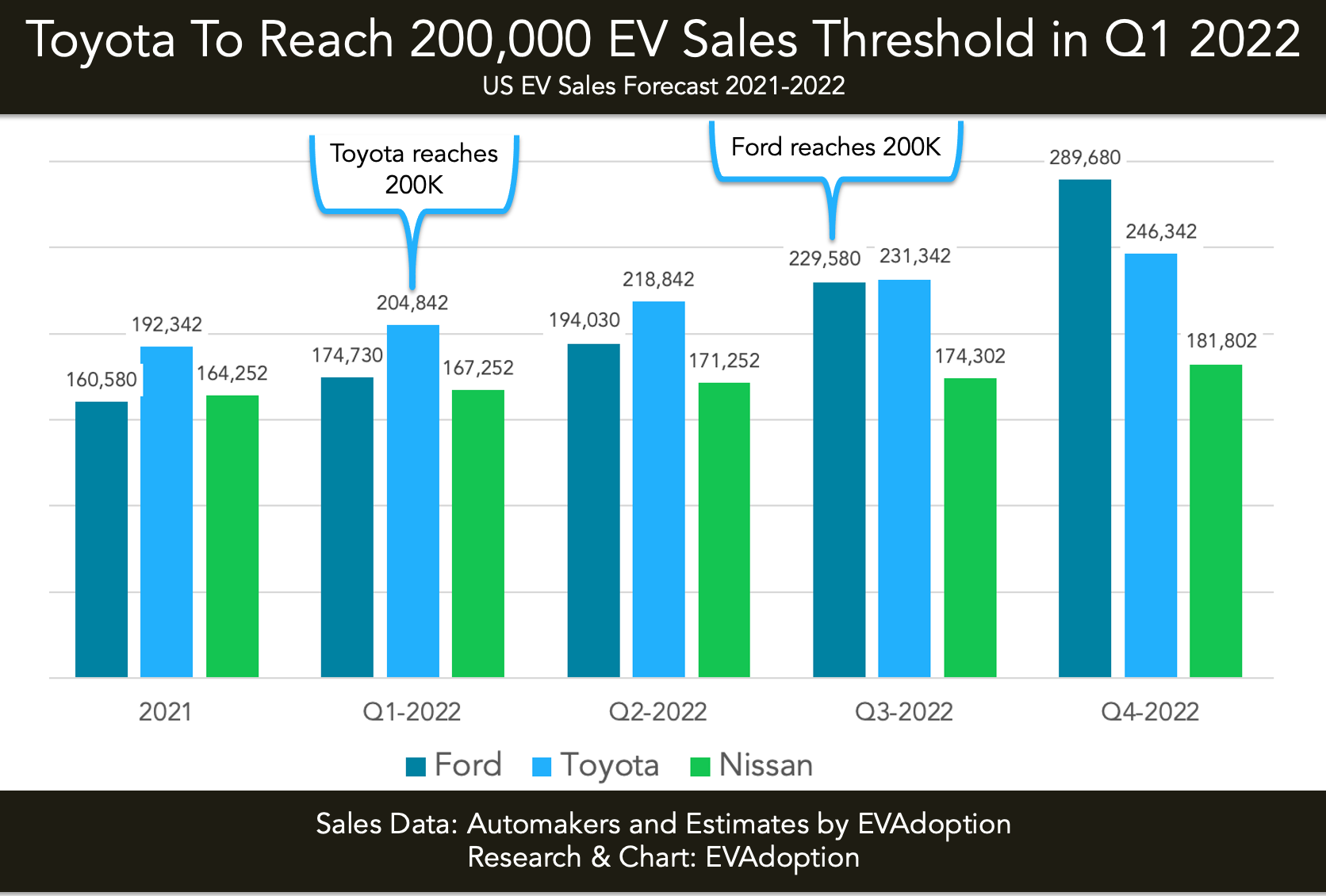

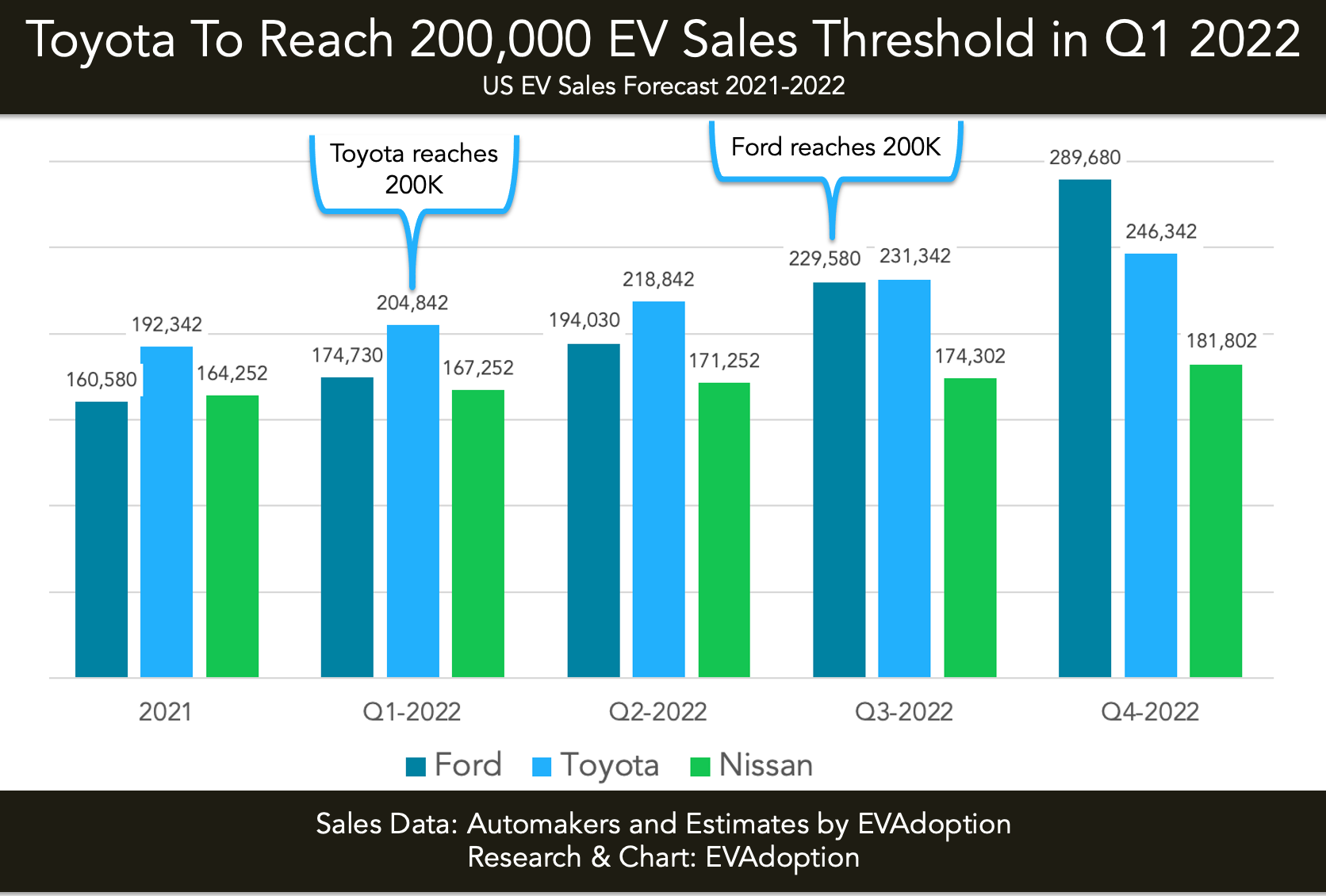

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The Japanese automaker which has offered hybrids and plug-in hybrids longer than the majority of other brands is about to hit the 200000-vehicle cap for the current federal tax credit limit. Automotive Editor - January 7 2022.

Notice 2022-12 page 906. Heres how you would qualify for the maximum credit. We expect EV sales in.

Increasing the base credit amount to 4000 from 2500 is fine. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. A similar bill was proposed in the Senate by Dean Heller a Republican representing Nevada.

4000 Base Tax Credit. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Keep in mind that the Canada EV incentives and rebates listed above may change depending on program availability.

2500 additional tax credit for qualifying EVs with final assembly in the US effective January 1 2022. After that it would phase out for all automakers. Even for EVs with giant batteries they arent.

Up to 5000 rebate on the installation of a charging station at your work or multi-unit residential building. For preapprovals processed through the date of this report 81863478 of the 100 million cap has been preapproved. Federal Tax Credit Up To 7500.

The credit applies to the year you buy the vehicle and your tax credit is capped at how. Will the cars currently eligible for the 7500 credit still qualify for the tax credits available when purchased or will they have to meet the new legislation terms. The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum.

QUALIFIED EDUCATION EXPENSE TAX CREDIT January 31 2022 The Qualified Education Expense Credit Cap is 100 million 2022 Year. His legislation would likewise eliminate the 200000-vehicle cap and allow for the full 7500 EV tax credit through 2022. The government caps the credit at 7500 maximum.

What happens if new ev tax credit or rebate laws are passed in 2022. President Bidens EV tax credit builds on top of the existing federal EV incentive. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022.

This rule is clearly intended to incentivize both US and non-US OEMs to assemble their EVs in the US. 2022 Calendar Year Federal Poverty Level Information. While foreign-based OEMs will be affected the most US automakers will also lose out on the credit in some cases as the Ford Mustang Mach-E is currently produced in Mexico and.

As such there is 18136522 remaining in the cap. Federal EV tax credits of 2500-7500 are available for new EVs and plug-in hybrids but not for hybrids. To qualify automakers must build the EV in the US with union labor for an extra 4500 over the current.

All-electric and plug-in hybrid cars purchased new in or after. Therefore if you owe more than 7500 in federal taxes in 2021 then taking delivery this year may still get you the original EV tax credit. Current EV tax credits top out at 7500.

General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018. The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. Then from October 2019 to March 2020 the credit drops to 1875.

Latest On Tesla Ev Tax Credit March 2022

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Used Ev Tax Credit Union Built Bonus Part Of House Social And Climate Bill Now Headed To Senate

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Income Eligibility Clean Vehicle Rebate Project

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ev Incentive Hike Faces Tortuous Path Through Congress Forbes Wheels

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac